Unreimbursed Employee Expenses 2024

- admin

- 0

- on

Unreimbursed Employee Expenses 2024 – the Tax Cut and Jobs Act of 2017 eliminated almost all tax deductions for unreimbursed employee expenses. Only a few specific types of W-2 employees can still claim work expenses: Reservists in . since the Tax Cuts and Jobs Act got rid of the unreimbursed employee expense deduction. However, W2 employee advisors may still be able to deduct some unreimbursed employee expenses on their state .

Unreimbursed Employee Expenses 2024

Source : www.linkedin.comMark R. Stanhope CPA PC | Hudson MA

Source : m.facebook.comStandard Business Mileage Rate Going up Slightly in 2024

Source : accountants.sva.comSIA Group

Source : www.facebook.comDr.Inc. (@DrInc9) / X

Source : twitter.comIRS Announces 2024 Tax Brackets, Standard Deductions And Other

Source : www.forbes.comEmployees’ Guide to Travel Expenses See The IRS Rules For 2024

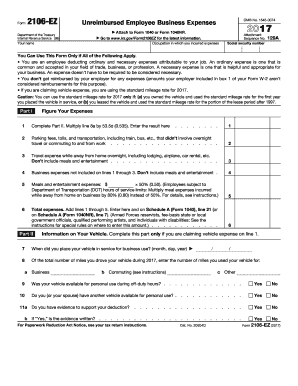

Source : www.driversnote.comIRS 2106 EZ 2017 2024 Fill out Tax Template Online

Source : www.uslegalforms.com2024 IRS Mileage Rate Increases PPL CPA

Source : www.pplcpa.comElection 2024 Tax Plans: Details & Analysis | Tax Foundation

Source : taxfoundation.orgUnreimbursed Employee Expenses 2024 🚗💨 IRS announces 2024 Standard Mileage Rates! 📈💼 | SIA Group : These expenses also include professional association dues, legal fees and others listed in IRS Publication 529. Beginning in 2018, these and other unreimbursed employee expenses are no longer . as a result of tax reform all miscellaneous “2%” expenses will be prohibited between 2018 and 2025, including employee unreimbursed expenses. Even if the employee is eligible to itemize deductions, .

]]>